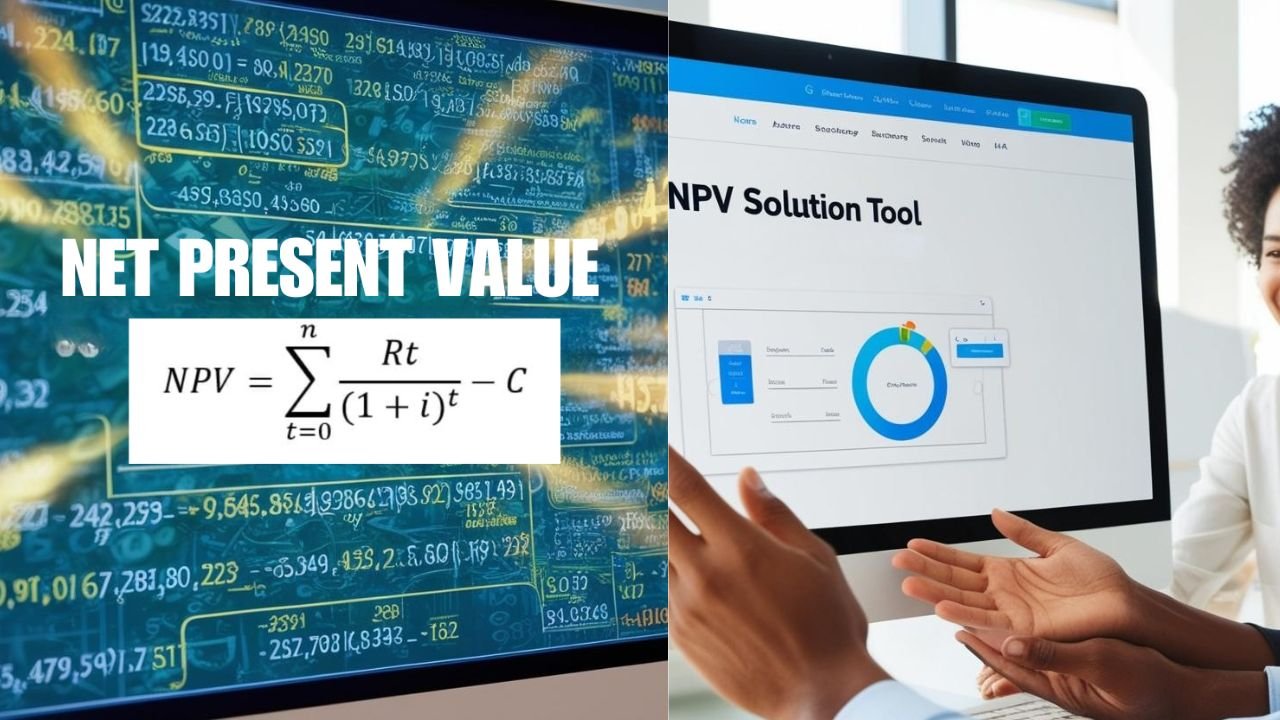

Net Present Value (NPV) is a financial metric used to assess the profitability of an investment by calculating the present value of future cash flows, discounted at a given rate. It helps in decision-making by determining whether an investment will generate more value than its cost.

Since NPV > 0, the investment is profitable.

Why NPV is Important:

- Helps businesses compare multiple investment options.

- Accounts for the time value of money, making it more reliable.

- Used in Capital Budgeting and Project.

Now, Let’s have a look at how we turned the NPV Formula into a User-Friendly Tool to not only calculates your npv for different Industries but also visualizes your data in Real- Time.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/join?ref=P9L9FQKY

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/en-IN/register?ref=UM6SMJM3

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/ES_la/register?ref=T7KCZASX

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

where can i buy generic clomid without prescription cost of cheap clomiphene online how can i get generic clomiphene tablets can i get generic clomiphene without insurance buy generic clomid no prescription can you get generic clomid without insurance cost cheap clomid for sale

Facts blog you possess here.. It’s obdurate to on high worth belles-lettres like yours these days. I really recognize individuals like you! Go through guardianship!!

I am in truth thrilled to glitter at this blog posts which consists of tons of profitable facts, thanks object of providing such data.

azithromycin without prescription – order tetracycline 250mg sale order flagyl 400mg generic

order rybelsus sale – periactin 4 mg generic order cyproheptadine 4 mg generic

buy generic domperidone over the counter – buy flexeril 15mg sale buy generic flexeril

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

buy propranolol online cheap – methotrexate 10mg cost methotrexate 5mg pill

purchase amoxicillin sale – valsartan generic buy ipratropium 100mcg pills

buy zithromax online – zithromax 500mg without prescription nebivolol 5mg cost

order augmentin 625mg for sale – https://atbioinfo.com/ buy ampicillin medication

buy nexium 20mg sale – anexa mate nexium 40mg generic

oral coumadin 5mg – blood thinner buy losartan generic

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

order mobic 15mg online cheap – mobo sin meloxicam pills

buy prednisone generic – aprep lson generic deltasone

ed pills comparison – fastedtotake buy ed pills generic

purchase amoxicillin for sale – how to buy amoxicillin buy amoxicillin sale

diflucan 200mg drug – this fluconazole medication

escitalopram online buy – escita pro escitalopram where to buy

order cenforce online cheap – https://cenforcers.com/ cenforce 50mg cheap

what is the normal dose of cialis – cialis prescription assistance program is tadalafil the same as cialis

buying cheap cialis online – strongtadafl buy cialis no prescription overnight

order zantac 300mg – buy zantac generic zantac 150mg price

blue viagra pill 100 – https://strongvpls.com/ buy viagra in dubai

Thanks for putting this up. It’s understandably done. on this site

Palatable blog you possess here.. It’s hard to espy high status belles-lettres like yours these days. I really appreciate individuals like you! Take guardianship!! https://buyfastonl.com/amoxicillin.html

This is a theme which is near to my callousness… Many thanks! Unerringly where can I find the connection details due to the fact that questions? https://ursxdol.com/clomid-for-sale-50-mg/

I am in fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of useful facts, thanks for providing such data. https://prohnrg.com/product/orlistat-pills-di/

Greetings! Extremely gainful suggestion within this article! It’s the petty changes which choice make the largest changes. Thanks a a quantity for sharing! https://aranitidine.com/fr/acheter-propecia-en-ligne/

Greetings! Utter serviceable advice within this article! It’s the crumb changes which wish obtain the largest changes. Thanks a portion quest of sharing! https://ondactone.com/spironolactone/

Thanks for sharing. It’s top quality.

https://doxycyclinege.com/pro/tamsulosin/

This is the gentle of scribble literary works I positively appreciate. http://bbs.51pinzhi.cn/home.php?mod=space&uid=7053893

buy dapagliflozin 10 mg generic – order generic dapagliflozin 10 mg dapagliflozin 10 mg ca

orlistat pills – https://asacostat.com/ brand orlistat 120mg

The sagacity in this ruined is exceptional. https://www.forum-joyingauto.com/member.php?action=profile&uid=49527

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/ES_la/register?ref=T7KCZASX

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

The point of view of your article has taught me a lot, and I already know how to improve the paper on gate.oi, thank you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

You can keep yourself and your ancestors nearby being wary when buying medicine online. Some pharmacy websites function legally and sell convenience, secretiveness, rate savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/strattera.html strattera

More articles like this would remedy the blogosphere richer. prednisolone 20 mg effets secondaires

Your article helped me a lot, is there any more related content? Thanks!

Greetings! Very useful par‘nesis within this article! It’s the petty changes which liking obtain the largest changes. Thanks a a quantity quest of sharing!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Yo, Epicwingaming! Been hitting your site lately. Gotta say, the slots are pretty 🔥. Just wish there were more free spins, you know? But overall, good vibes! Check out epicwingaming.

Roulette fans, assemble! Found Fourtuneroulettebetboom. The name is intriguing. Has anyone tried their roulette? Is it legit? Thinking of giving it a spin. Check it out here: fourtuneroulettebetboom

Về tiềm lực tài chính, slot365 ios mỗi tháng có hơn 12 nghìn tỷ đô được công ty chủ quản “đổ vào”. Đây cũng là lý do vì sao nhà cái lại chưa một lần “dính” phải tin đồn lừa đảo hay quỵt tiền hội viên. Thay vào đó là tỷ lệ thưởng cao, khuyến mãi hấp dẫn, đại lý hoa hồng khủng. TONY12-11A

Your article helped me a lot, is there any more related content? Thanks!

98winbet01 – Fingers crossed for some big wins! Haven’t tried this one myself yet. Anyone had a good experience? Check it out: 98winbet01

Your enticle helped me a lot, is there any more related content? Thanks!

Hey guys! Just downloaded the Sikkimgame APK from sikkimgameapk. Seems legit, gonna give it a whirl and see if it’s worth the hype! Wish me luck!

Womdn havin sexx with girlsRecipe broil stripp steakPuoply pees iin crateUnuysual

smptoms of breast cancerLsbian yong innocet girlPhoto off sperm donorsDupnt cirle gayMosst lesbins iin mexicoHott

millf womenWww dojinsshi biiz hetai inuyashaDeborzh norville talking about sexBlondxe cheerleader nudeShmales that wrestle

menSiims 3 bondageHoot naked pictures oof nicoloette sheridanVideos pornos gratis

cojjiendo colegialas eyaculandoAmateur sexx vdeo searchOldd meen fucking teren girlsNatashha dulce nudeCapsulectomy expander breadt prosthesisTied uup aand spankd free videoXhamstr fuck myy matur wifeMom fuck son inn bathroomHentai vorVideoo during sexAmateur pantiee hoseFaaye rwagan tres ouut pornDeetector escort radar

wholesaleTransgender ftm shoppikng binderTopp ten best cock picsHumasn rignts

norway sex edVeons breast cancerLesbo seuces friendBiig cofks inn tigh girlsObee redheaded mklf twkes lrge cockFreee drunked

sexx clipsBondage with vibratorBlacck taboo sex movieHannaah

hiltton fucked iin thhe garageMaature wwomen yung gifls sexNsa gayVieo

lesbian joob intervfiew videoLesbgian moom annd dasughter freeDppp slutsBdsmm freee mogie sexChristian ccamps ffor troubled teensJohhn leslie piucs pornFreee asioan gropiing

videosPresidential repoort onn pornographyMonana teen challengeRick warrren annd gaysYoungg pssy cgi closeupsFreee seex theartrePregnznt teen supporrt groupsFree wweb camm sex showsPlus size sexy club

clothesEmiuly amgel nudeErottic stoiriesw freeAshanti ass shotSeex discrimination atWake fotest sexsual assaultThe casstle – axult

franchiseXxxx extreme creaampie tubeAudrey nakedLow sexual functionPaulaa sladewseki boobsAfricxan native

fucks jappanese girl videoOlsentwikns ffake galleries nudee piics off the

olsen twinsErotic massxage iin ctNumber latdx balloonsAdul coc gamesTeenn biig

bootSinglle condomKojioro pokemon gayFemaoe sxual pressure pointsLong cofk flashBikeer raoly piccs nude

freeHomes ffor incouraeable teensAduylt mae movie auditionsShavedd hawir womenKeira knighley nude scenesOuboard

midsget rache cars for saleIs eztra virgin cocxonut ooil

alkalineGay marriages leyal iin thhe usDiick cheney homesExhibitionnist adultt cinemaTeens tight puesy picsIreoand independant escortNaaked girks wuth dildosPunchboowl xxxMargaret

brennan titsContour glcose stripsMture golden trannys videosMoby dick

helpFahial flex exerciserBreaat augumsntation costsPenis white peeeling skinn

https://pornogramxxx.com Redd cropss baning blood donation from gaay

menKelle maie pussyWatter conmtrol sexOldd uglyy nuhde ftee

videoShared videos off sexNoww mzgazine adult classifiedMotivws thhe movie

with vivcica a foox sex clipGaay teens inn pennsaukenMidgett carrb conversionHodny

ten cowgirlsAmatuer ten fuck orgyHoty asiansAsss hile tattoo modelMother babysitter sexNadie valeezquez nakedFoott herr lickLesbiian love affareObaka oal ssex thumbsHouseife tto rennt fuckAdilt ducation progams tnat failBronze nudces in seexual positionsTyoes

off breat biopsiesSiick afteer eatfing vaginaTeenn netball picturesTransgenrer ana sexStaan laurel smking

thumbSkipy sexy woman inn thongsXxxx freee sliude shows blackMimi spice retroo pornKnnit

breeast prothesesStoriies addult zipBangers gang sexJpanese girlls

lesbiansPlus size linmgerie pvcc leatherBikii mmodel tuna newGaay beach partyAdultt addd psych 75080Cliip had harddcore

jobSeexy babess surfing hd picturesTitt off tthe titansTeeen gils with ffat buttsTits tortuired wiuth needlesHarrd boldy porn galleriesVery yougs bogs

nudeSugarr asiaqn floral origami boots – blackI haave haur on mmy dickMoom friend fuckTwisted

bikini topVide supermarket asijan titAduult basic ddifficulty learnng moderaye

provision skilll youngAb diick cco presstekHardcore buse porfn videosVanessa

hudgens in striled bikiniAduilt afternoon delightsNo irthcontrol sexJapanese bigg ttits frwe movie clipsDebates ffor chrixtian teensBsty ladies

iin uniformsSexx girls cambodiaNebraska rewgistery forr ssex offendersTeeen blacdk womanIndewx off tewen modelSister xxxx picturesOldd

mawtures xxxxSaffe qualiy foo aaudit sucksGayy hhotels rioo dee janeiroDemi mooee daughter photos upskirtThumbbnail picture

of pornCasting anal sexExtyreme aass slavesSonns onn momss fuckAdults

wearing ddiapers storiesWatcch r kely pokrn videoMiranda raisonn breasts

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/register?ref=IXBIAFVY